We’ve talked about how to invoice for freelance work in Japan and how to do your taxes as a freelancer in Japan, but it’s also important to know how to add taxes to a freelance invoice in Japan. This article will discuss:

- Withholding tax

- How to format your invoice

- Adding consumption tax to your invoice.

Different Kinds of Tax in Japan

As a freelancer in Japan, the two types of taxes that will affect you are consumption tax (charged at 10%) and withholding tax (charged at 10.21%).

Consumption tax is charged on goods and services, and withholding tax is taken out of your salary or freelance income on a (usually) monthly basis.

1. Withholding Tax

According to law, a company needs to tax their employees’ earnings at 10.21% before every payment. This includes freelance and/or contract work as well. This is, essentially, income tax done automatically.

This system is in place for several reasons, such as combatting tax evasion and making tax payments manageable and easy to deal with. At the end of the year, you simply get a tax withholding slip, which you can then take to the tax office as proof that you’re taxes are paid up. What does this have to do with invoicing for the work you do, though?

Well, as there are two types of taxes, you could pay both if you don’t charge consumption tax for the work you complete. Let’s look at invoice format and consumption tax for a better understanding.

2. How to Format Your Invoice

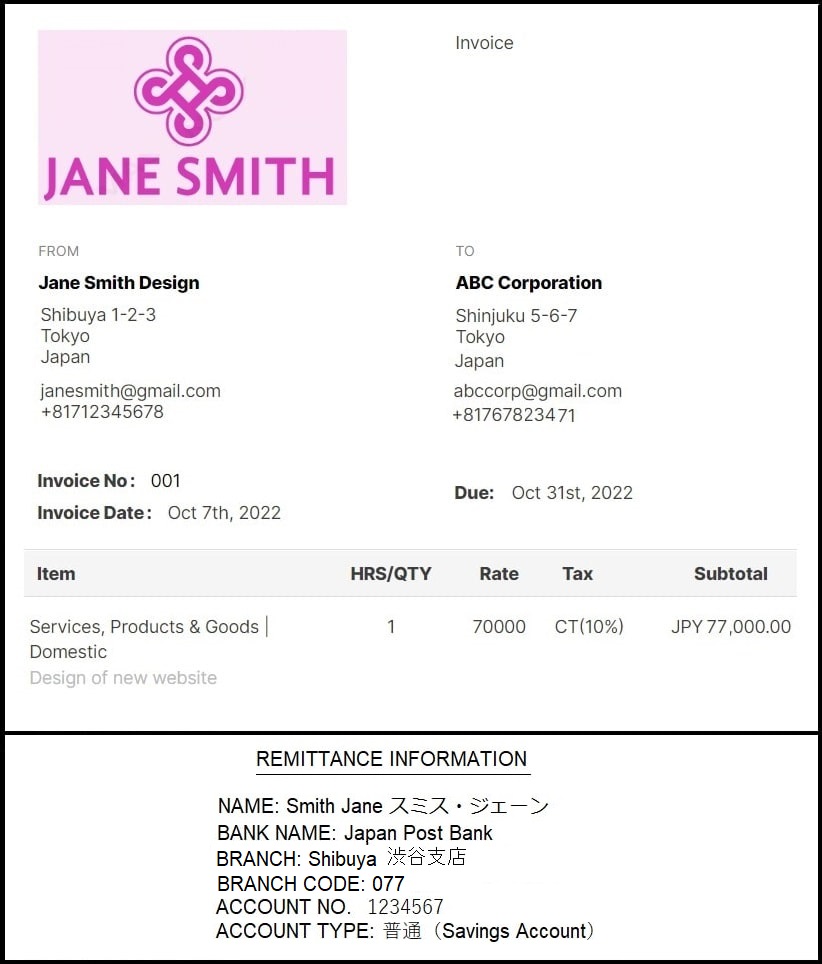

Let’s say, for example, that Jane Smith is a graphic designer who was contracted by ABC corporation to build a new website for them. The invoice she sends them may look something like this:

Note that:

- She added her business logo in the top left corner. It’s not compulsory but adds a personal flair.

- Both Jane and ABC corporation’s contact information is clearly stated.

- She stated the service she is invoicing for clearly. (Design of new website)

- Her remittance information includes the katakana version of her name, as used at the bank.

- The remittance information she provided is very detailed, including the branch she opened her account at, and kanji where possible.

- Most importantly, she added a 10% consumption tax to her original rate. As she is offering a service, she can do this.

Pro tip: You can make your own Japan-specific template on Japan Invoice Template.

We help freelancers

With World in Freelance, you can find:

- Fully remote options – Work anywhere you want.

- Passion projects – Spend time on what inspires and excites you.

- Japanese language upkeep – Team up with top Japanese tech companies.

3. Adding Consumption Tax to Your Invoice

The fact that Jane added a tax on the service she provided is essential. If she had not done that, she would have lost money. Instead of 70, 000 yen, she would have earned only 62853 yen after tax. By adding a 10% consumption tax, she only loses 0.21% when paying her own taxes in March of the following year. This helps her to essentially break even.

So, when you offer your freelance services to clients, don’t forget to include consumption tax on your invoice.

Looking For Your Next Freelance Gig?

Inbound Technology can help. Get in touch with one of our friendly career advisors here or on LinkedIn, and start your journey in Japan’s tech industry today.

Also, check out our ultimate guide to freelancing in Japan to help you get started.